About Us

Aim

To transform the lifestyle of fishing families into a superficially developed community by providing accessibility to competitive knowledge and infrastructure.

Vision & Values

To ensure harmonious and sustainable living with a holistic approach among fishing community.

Founding Trustees

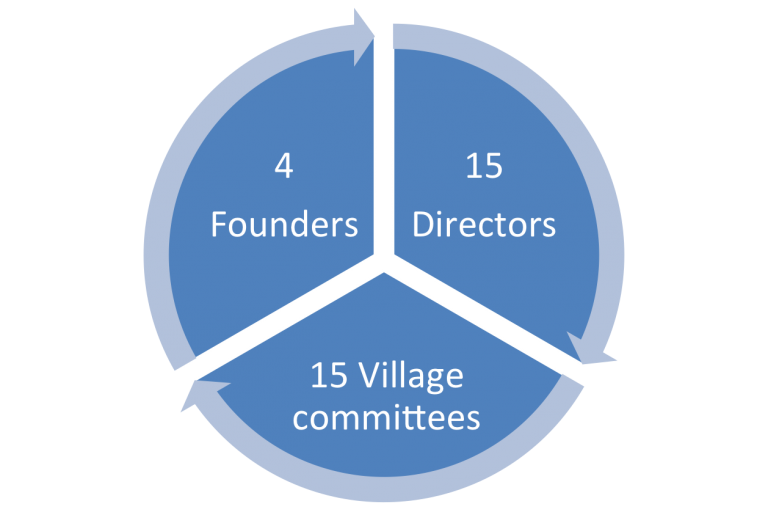

The Trust is encompassed with 3 different components; Founders, Directors and Village committees.

It composed with mixture of professionals from various areas; Fishermen, Administrators, Entrepreneurs, Engineers, Scientists, Teachers and Officials.

Trust Members

Members of the trust appointed by the founding trustees for the operation by adhering to the scope and rules of the Trust. They will comprise a maximum of 15 numbers at any point of the life period of the Trust.

Board Of Directors

Board of Directors will directions for all the activities of the trust.

Staffs

Staffs appointed by the trust will work according to the job descriptions highlighted during the appointment.

Volunteers

Volunteers will be selected time to time by the Trust for helping with the activities of the trust.

Governing rules and protocols

1. The trust shall maintain regular and proper accounts of all receipts, payments, properties, assets and liabilities. Such accounts shall be kept at the office of the trust.

2. The board of directors can form and dissolve various committees, sub committees for the smooth working of the trust.

3. The financial year shall end on 31st day of March each year.

4. The accounts shall be got audited by a Chartered Accountant in Practice.

5. The trustees are empowered to formulate rules and regulations for carrying on their working, distribution of charities, holding of the meeting, appointments and dismissal of the members/staffs.

6. The Trust will not carry out any activities with the intention of earning profit and will perform with service motive only and No activities of the Trust will be carried out outside India.

7. The income and the properties of the Trust will be solely utilized towards the objects of the Trust and no portion of it will be utilized for payment to the Founder or Trustees or their relatives by way of salary, allowances, profit, interest, dividend etc.

8. To invest the Trust funds in the manner not prohibited by any provisions of the Income Tax Act, 1961.

9. To buy, sell, mortgage, grant, lease, hire or otherwise alienate all or any of the properties of the Trust in its discretion for adequate consideration

10. To execute power of attorney or powers of attorney to any person for the purpose of executing, administering or managing the whole or any part of the Trust for the purpose of all or some among the objects of the Trust.

11. To receive, collect and enforce recovery of all monies due or payable to the Trust and grant receipts and discharges therefore.

12. To receive voluntary contributions from any person or persons from India or outside, after complying with the statutory formalities, by way of donation, gifts or in any other manner and to hold the same upon Trust for the objects set forth herein.

13. To appoint, suspend, dismiss or otherwise deal with the staff required for the administration of the Trust, to frame rules relating to their salaries and other benefits and generally to exercise all powers ancillary and incidental to effectively carry out the objects of the Trust.

14. No one shall commit any act or breach of Trust of the Trust fund or property or cause any loss to the Trust property or commit fraud in the administration of the Trust fund / property.

15. The Trust staffs holding appointments shall be entitled to any Salary, allowances or perquisites, and reimbursement of actual expenses incurred in connection with attending to the Trust matters.

16. Board of directors and members of the Trust are not allowed to utilize the trust funds for their transport, food and stay while travelling for Trust related activities in Tamilnadu and Pondicherry.

17. Applicability of Trust Act: The provisions of the Indian Trust Act 1882 shall apply to all matters not specifically mentioned in these presents.

18. Application of Income Tax Act 1961: All clauses herein are intended to secure exemption from Income Tax on the income of contributions and donations to the Trust and any clause or portion of this Deed of Trust which is inconsistent with or repugnant to the sections of the Income Tax Act, 1961 as amended, substituted or modified from time to time, shall be deemed to be deleted or modified with effect from the date on which the sections to which the clause or part of a clause is repugnant or inconsistent comes into force.

19. Dissolution: In the event of dissolution of the Trust, the entire Trust funds shall be realized and first be used for payment of liabilities of the Trust.

20. The assets left if any, shall be disbursed to other Trusts or Associations having similar objectives after obtaining previous approval of Commissioner of Income-tax and in no event it shall be distributed in any manner, to any of the Board of Trustees or their relatives or related concerns.

Accounts and auditing

The board of Trustees may open bank account(s) and maintain in the name of the Trust, Bank account or accounts with scheduled banks and same shall be operated under the signatures of two trustees. The accounts may also be operated by such trustees or officers or employees as may be nominated by the board of Trustees from time to time.

The trust shall maintain regular and proper accounts of all receipts, payments, properties, assets and liabilities. Such accounts shall be kept at the time office of the trust and form and dissolve various committees, sub committees for the smooth working of the trust. The financial year shall end on 31st day of March each year. The accounts shall be got audited by a Chartered Accountant in Practice.